Achieve your potential

with your own mortgage broking business

With our extensive and customisable product array, you can seize a fantastic business opportunity of catering to a large untapped customer base.

Looking to join a YBR Franchise?

Ready to thrive in the Australian Mortgage Broking sector?

YBR’s franchise opportunity is your ticket to success. Mortgage brokers settle over 69% of residential home loans in 2023, and borrowers are seeking expert guidance more than ever.

As a YBR franchisee, you’ll step into a world of endless possibilities.

Join us and become a trusted advisor, serving clients from all walks of life, including those underserved by traditional lenders.

Your future as a YBR mortgage broker starts here, so seize the opportunity to make an impact and grow a thriving mortgage business.

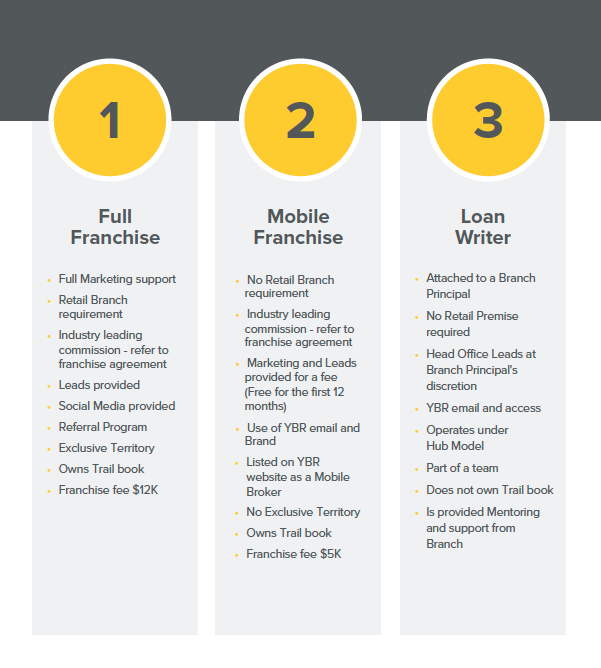

YBR Franchisee

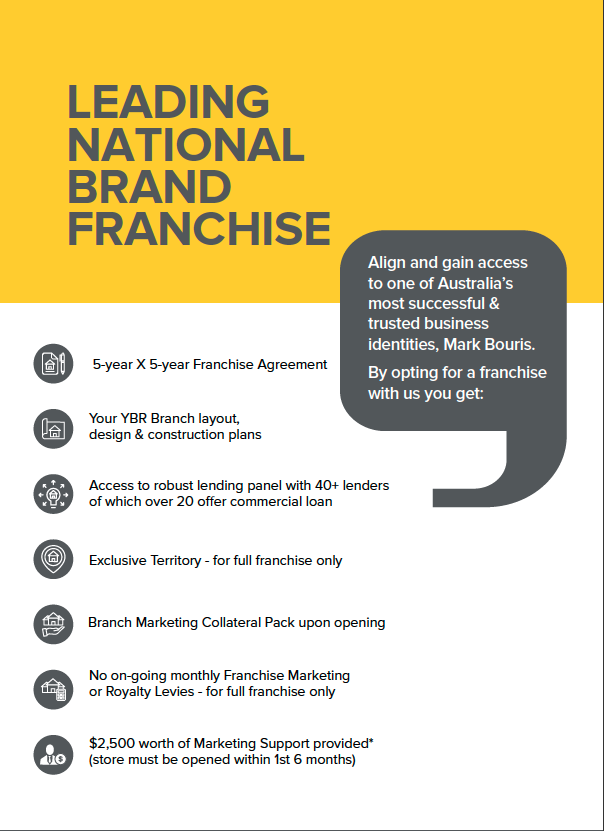

Work and operate with the backing of our national brand with exclusivity of operation. Receive access to our robust lender panel, support infrastructure, as well as industry-leading digital marketing support.

Loan Writer

Not quite ready to run your own business? Enter the mortgage industry with the right support to write loans through one of our franchisees. Build your expertise and experience with minimal investment.

Mobile Franchisee

Not ready for a big financial commitment? Learn more about our newest business model – ‘YBR Mobile Broker’. This cleverly designed model lets you enter the mortgage business space with lesser capital and does not require you to have a retail branch.

Why Join Us?

YBR stands out in the industry for two primary reasons. First, we offer a digitalised approach to understanding borrowers better. Through significant investments in our digital capabilities, we map borrower journeys and provide actionable customer insights and feedback to enhance your business. For example, we capture borrower details before initial contact, enabling precise targeting with the right messaging and product offerings.

Secondly, as a YBR franchisee, you’ll enjoy the benefits of our state-of-the-art Customer Relationship Management system, Ynet2.0, which utilizes the premium Salestrekker platform. This system streamlines mortgage processes, saving you valuable time. Additionally, our compliance support is among the best in the industry, ensuring you stay updated on the latest policy developments and changes.

In summary, joining YBR means gaining access to a thriving mortgage broking sector and leveraging our two-pronged approach: tailored solutions for underserved clients and a cutting-edge digitalised approach. With YBR, you’ll have the tools and support needed to grow your business and navigate the ever-changing landscape of mortgage broking.

YBR Franchise Services

Marketing Support

Our meticulously planned marketing approach incorporates national, local and digital expertise for precise and targeted results. With a customised marketing plan tailored in close coordination with your YBR State manager and the YBR head office marketing team you get:

Strong Digital Capabilities

Strong Digital Capabilities: YBR has transformed itself into a financial technology company. In addition to a great brand and extensive branch network, we have been building our digital capabilities. Our digital approach to customer engagement is one of its kind in the Australian mortgage industry. For instance, while other lenders capture information about individual customers at the first point of contact, YBR deploys its digital assets and technology to understand customer needs before they speak to a broker. In addition to digital marketing support, we provide you with tangible metrics on:

Leads generated

Website traffic

Online customer engagement

Regularly monitor your progress and receive guidance on timely action.

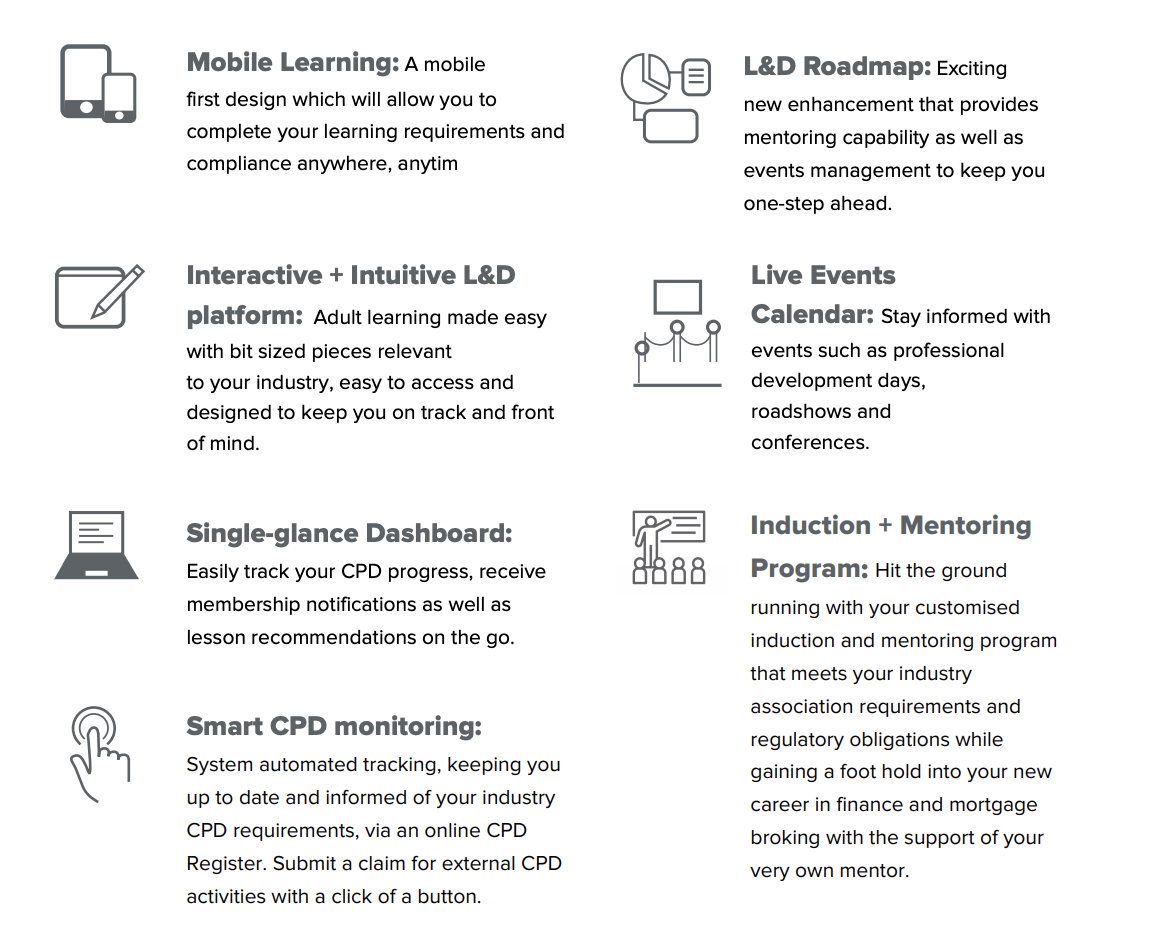

Training and Development

Our digitalised approach towards learning and development allows you to fulfill professional requirements while staying updated on the latest developments and industry best practices. Take a systematic trackable approach to learn at your own pace with a host of formats you can access anywhere, anytime. With our state-of-the-art learning platform, you get access to:

Expert Support

After getting you up and running we continue to be there for you for day-to-day advice and support. We also help you navigate challenging times and crises. Our extensive support infrastructure includes.

Transparent Commission Structure

Diverse Product Array

We understand that each borrower is unique.

With us, you could be assured of long term, mutually beneficial client relationships based on honesty, reliability, and trust.

Talk with a

team member today!

"*" indicates required fields